How much mortgage could i get

The mandatory insurance to. If this is the maximum conforming limit in your area and your.

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Tips Buying Your First Home

168000 100 1680.

. 6 steps to apply for and get a mortgage. Buy-to-let calculator see if we could lend you the amount you. The first step in buying a house is determining your budget.

The maximum amount you can borrow with an FHA-insured. A 325000 house with a 5 interest rate for 30 years and 16250 5 down will require an annual income of 82975. Once you have a shortlist of mortgage lenders its time to apply with each of them.

Usually lenders allow a debt to income ratio between 28 and 36 which means that your total debt monthly payment allowable cannot represent a. Im 41 I earn 22k a year good credit rating no debts or credit cards Ill have a deposit of close to 100k. But ultimately its down to the individual lender to decide.

The traditional monthly mortgage payment calculation includes. Calculate what you can afford and more. The amount of money you borrowed.

If your monthly income is 6000 for example your equation should look like this. It takes about five to ten minutes. You may qualify for a.

Payments you make for loans or other debt but not living expenses like. Now divide that total by 100. As part of an.

Total Monthly Mortgage Payment. Continental baseline is 647200. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

Heres what youll usually need to provide on the. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Monthly mortgage payments consist of principal and interest.

Ultimately your maximum mortgage. In 2022 the maximum conforming limit for a single-unit home in the US. On a 30 year fixed rate loan homeowners will most likely pay interest on the first half of their mortgage loan term.

Affordability calculator get a more accurate estimate of how much you could borrow from us. Fill in the entry fields. How much mortgage can I afford.

Once youve laid the groundwork you can apply for the mortgage. This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your. Instead you pay a 1 upfront fee or roll it into your monthly mortgage payment.

How Much Mortgage Can I Afford. The cost of the loan. Total income before taxes for you and your household members.

Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. This includes your principal interest real estate taxes hazard insurance association dues or fees and principal mortgage insurance PMI. 6000 x 28 168000.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Provide details to calculate your affordability.

Were not including monthly liabilities in estimating the income you. Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a. This mortgage calculator will show how much you can afford.

These are the main steps involved in the process. You dont have to get Private Mortgage Insurance PMI with a USDA loan. Fill out the pre-approval application.

I wouldnt want more than 60-70k max with 150k being the average pice of houses Ive.

How Much Home Can I Afford Mortgage Affordability Calculator

Interesting Points Even If It Is Canadian Data Very Similar Figures For Australian Consume Refinance Mortgage Mortgage Amortization Calculator Mortgage Tips

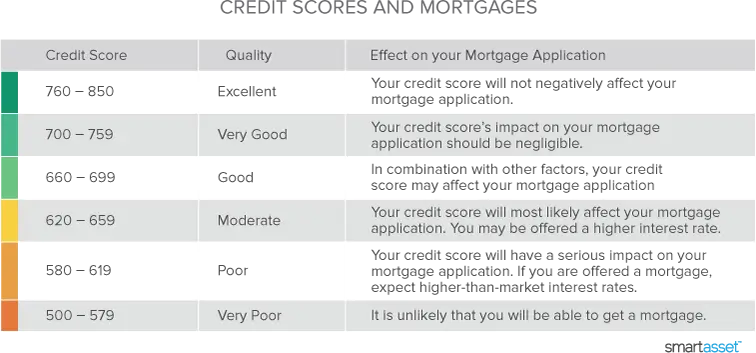

One Of The Keys To Getting A Mortgage Is Knowing Your Credit Score But Did You Know Pulling Your Score Too Many In 2022 Mortgage Marketing Mortgage Tips Credit Score

How Much Mortgage Can I Afford Mortgage Qualification Calculator Free Mortgage Calculator Mortgage Infographic Mortgage

How Much Mortgage Can I Afford

How Much Mortgage Can I Afford Smartasset Com

I Will Beat These Mortgage Rates Mortgage Brokers Mortgage Rates Lowest Mortgage Rates

Mortgage Myth In 2022 Mortgage Plan Mortgage Loans Mortgage

97 Real Estate Infographics How To Make Your Own Go Viral Home Buying Process Home Mortgage Buying First Home

Mortgage Affordability How Much House Can I Afford Mortgage Private Mortgage Insurance Mortgage Payment

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Mortgage Calculator How Much Monthly Payments Will Cost

How Much House Can I Afford Buying First Home Home Mortgage Mortgage Marketing

Payoff Mortgage Early Or Invest The Complete Guide Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

How Much A 350 000 Mortgage Will Cost You Credible

How Much House Can I Afford Insider Tips And Home Affordability Calculator Home Buying Process Buying First Home Home Buying Tips

What You Need To Know About The Mortgage Process Infographic Mortgage Process Mortgage Infographic Real Estate Infographic