Estimated taxes 2021

If you are self employed or run a business pay attention to this years estimated tax deadlines to avoid paying penalties. 2020 Tax Rate Increase for income.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

10 of the taxable income.

. 513-352-2546 513-352-2542 fax taxwebmastercincinnati-ohgov. The 2022 Estimated Tax Worksheet The Instructions for the 2022 Estimated Tax Worksheet The 2022 Tax Rate Schedules and Your 2021 tax return and instructions to use as a guide to. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I.

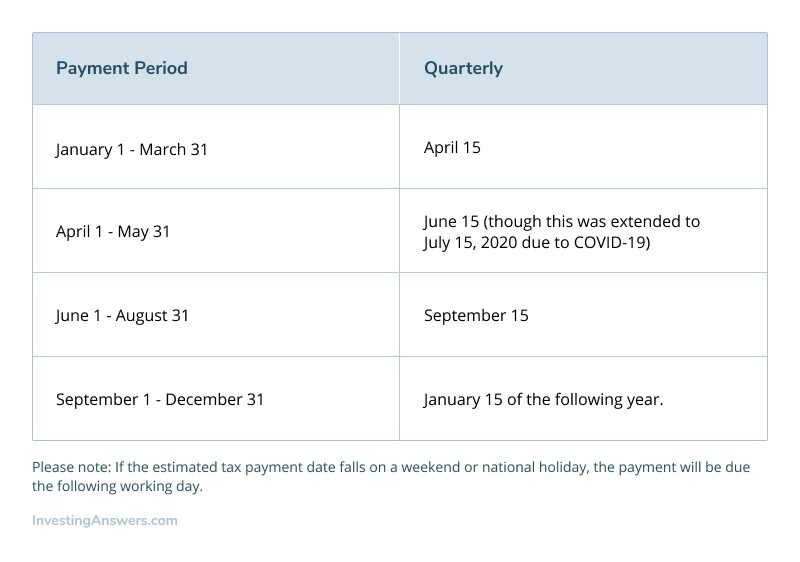

Payments due April 15 June 15. The total of your credits including estimated tax payments is less than 90 of this years tax due or 100 of last years tax due 110 of last years tax if your federal adjusted gross income is. On the Landing page select.

There is a formula you can use to figure your self. Estimated tax is the method used to pay tax on income when no taxor not enough taxis withheld. Visit Alabama Interactive for online.

You have nonresident alien status. You may be required to make estimated tax payments to. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Or d your expected estimated tax liability exceeds your withholding and tax credits by 150 or less. Due Dates Estimated tax payments are due in four equal installments on the following dates.

April 15 first calendar quarter June 15 second. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with Extension. Electronic funds transfer Online Services - Its secure easy and convenient.

Estimated Income Tax Worksheet on Page 3 is less than 11950. Make Business Payments or Schedule Estimated Payments with the Electronic Federal Tax Payment System EFTPS For businesses tax professionals and individuals. See below for options to file your estimated taxes.

100 of the tax shown on your 2021 return. Self-employment tax is part of your overall tax liability and is one thing that makes estimating total tax liability difficult. 425 57 votes The deadline for making a payment for the fourth quarter of 2021 is Tuesday January 18 2022.

Single Individuals Not over 9950. If you owe additional taxes during the year you may have to pay estimated tax on the upcoming year. Then income tax equals.

2021 Personal Income Tax Forms. You can make a single payment or schedule all four payments at once. Attachment to Form IT-2658 Report of Estimated Metropolitan Commuter Transportation Mobility Tax MCTMT for New York Nonresident Individual Partners.

For 2021 taxes filed in 2022 the fully refundable Child. You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. Income taxes are pay-as-you-go.

And is based on the tax brackets of 2021 and. For additional information see FYI Income 51. WHEN TO FILE Make.

It is mainly intended for residents of the US. Estimate your tax withholding with the new Form W-4P. Income Tax Office 805 Central Ave Suite 600 Cincinnati OH 45202.

If you estimate that you will owe more than 400 in New Jersey Income Tax at the end of the year you are required to make estimated payments. Use this package to figure the estimation of tax in 2021 TY.

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

How Much Does A Small Business Pay In Taxes

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Center For Phds In Training For 2021 2022 Personal Finance For Phds

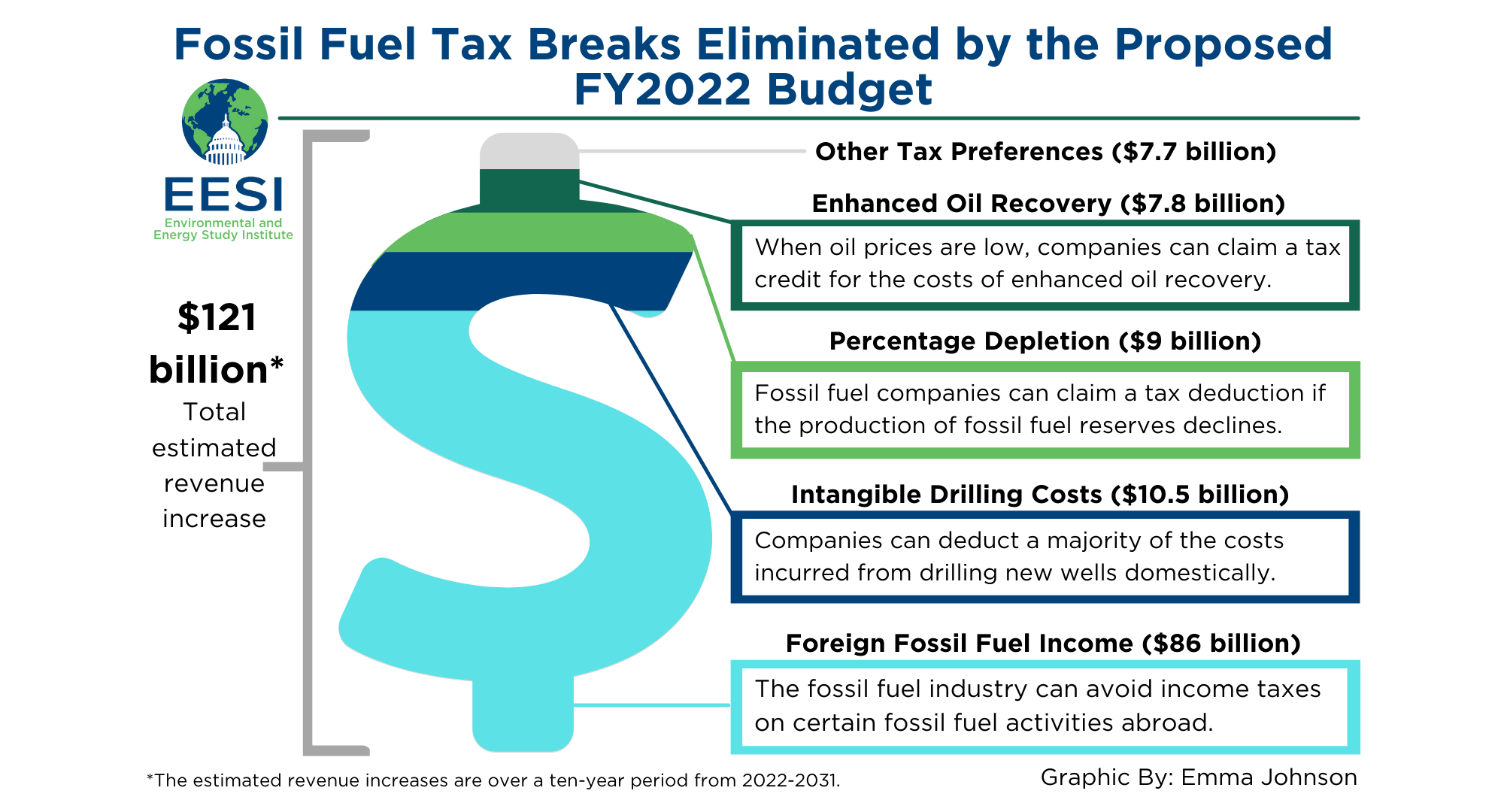

Fact Sheet Proposals To Reduce Fossil Fuel Subsidies 2021 White Papers Eesi

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

What Happens If You Miss A Quarterly Estimated Tax Payment

Fiscal Quarters Q1 Q2 Q3 Q4 Investinganswers

When Are Taxes Due In 2022 Forbes Advisor

Estimated Tax Payments Youtube

Estimated Tax Payments For Independent Contractors A Complete Guide

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Tax Schedule

Tax Schedule

Estimated Income Tax Payments For 2022 And 2023 Pay Online